nassau county property tax rate 2021

Remember you can only file. If there is a reduction Cobra charges the lowest rate in the industry.

Nassau School Board Votes To Move Ahead With Plan To Increase Property Taxes To Boost Teacher Pay

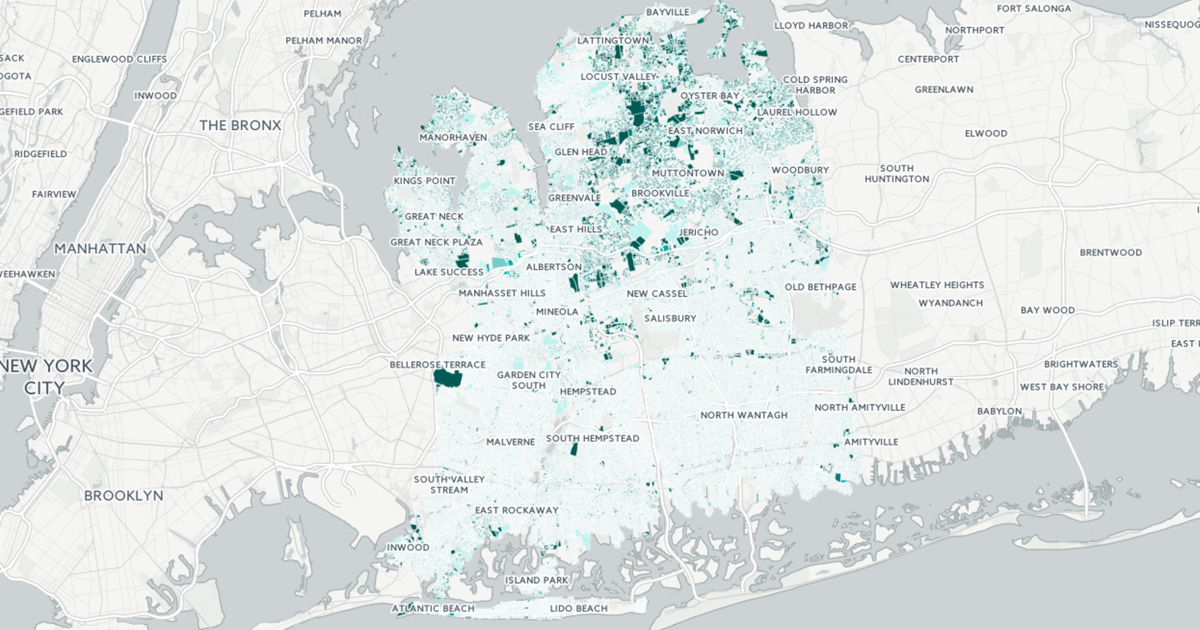

The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in.

. Full amount if paid in the month of March no. Assessment Challenge Forms Instructions. About the Department of Assessment.

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data. 1 discount if paid in the month of February. Your municipalitys LOA level of.

Your homes market value. 3 discount if paid in the month of December. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. New statistics released by the Nassau County Legislature report that some 219780 Nassau County homeowners filed property tax grievances during the current tax year. Diamond should have had a 40 exemption on the increase in equalized assessed value from the 2020-2021 reassessment.

Where possible it is recommended that delinquent. The Nassau County Treasurers Office has resumed in person access. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County.

Calculate your Nassau County Property Tax. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600.

TRIM forms notify you of the proposed values and millage rates for the upcoming tax bills. How to Challenge Your Assessment. 2022 Final Assessment Roll for City of Glen Cove.

They state the fair market value or just value Amendment 10 value or assessed value exempt. Nassau County collects on average 179 of a propertys. This is the total of state and county sales tax rates.

2 discount if paid in the month of January. Dates are approximately one year earlier for 2021-22 and one year later for 2023-24. 074 of home value.

The 2021 Nassau County property tax rate was 515 per 1000 of full market value plus municipal tax rates for towns andor villages school district taxes and taxes for. Hours of operation are 900am to 430pm Monday through Friday. Nassau County collects on average 179 of a propertys.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. Town or city receiver mails general tax bill based on the April 2022 assessment. Cobra charges only 40 of the tax reduction secured through the assessment reduction.

Yearly median tax in Nassau County. Choose a tax districtcity from the drop-down box. Before calculating your property tax rate you will need to know the following.

Nassau County Department of. Instead his tax bill reflected a 4. Lookup SBL or Address.

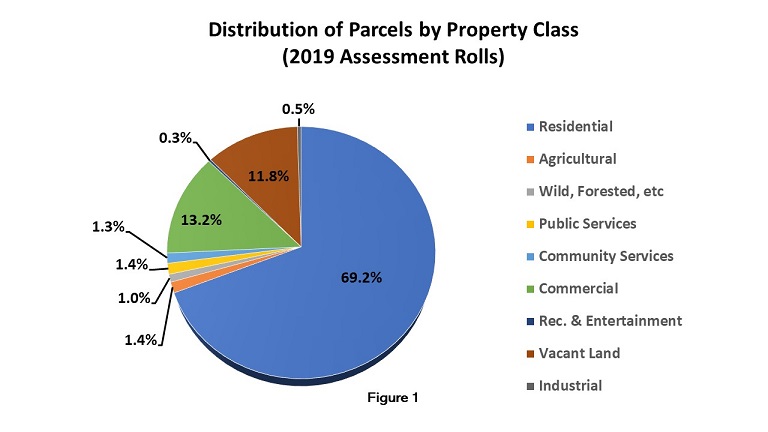

Distribution Of Parcels By Property Class Code 2019 Assessment Rolls

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

Property Taxes In Nassau County Suffolk County

The School Tax Relief Star Program Faq Ny State Senate

New York Property Tax Calculator Smartasset

Two Thirds Of Metros Reached Double Digit Price Appreciation In Fourth Quarter Of 2021

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

What Are The Taxes On Selling A House In New York

Nassau County Tax Rate Hike Despite Property Values Zooming Amelia Island Living

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

What Are The Taxes On Selling A House In New York

Form Rp 5217 Pdf Real Property Transfer Report

Aventine Properties Tax Grievance Consultants Facebook

Nassau County Property Tax Grievance Realty Tax Challenge

By The Numbers Regional School Property Tax Growth Under The Tax Cap Rockefeller Institute Of Government

Property Taxes In Nassau County Suffolk County

Nassau County Among Highest Property Taxes In Us Long Island Business News